Turn invoices into cash to finance your growth!

Offer flexible payment terms to your buyers.

Submit your invoices and get paid as soon as you ship.

Higher Credit Line

Cost-efficient

LIBOR + %

Simple access

No collateral

The Keskan Advantage

Collateral Free Finance

Submit your invoices and get advances against your shipments!

Improve Margins & Flexibility

Pay for your raw materials immediately, increase your margins, and offer your customers flexible payment terms

Grow Sales & Lower Costs

We help solve your cash flow problems so you can focus on growing the topline and bottom-line of your business.

Fast & Transparent

Get onboarded with minimal paperwork, finance your invoices from Keskan’s portal and receive funds within 48 hours.

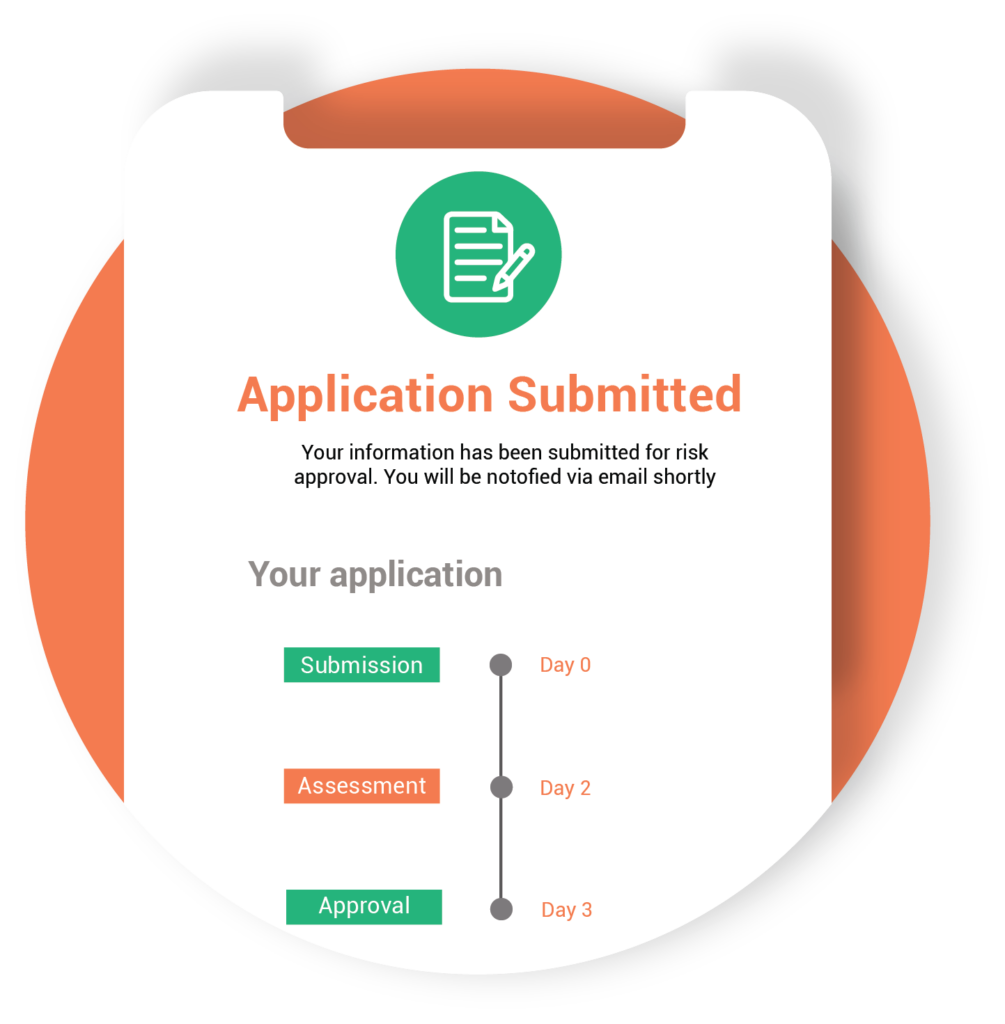

Simple 3-Step Application Process

Credit Assessment

Submit basic details about your business.

Submit Invoices

Securely upload your invoices and documents on our dashboard.

48 Hour Disbursements

Get up to 80% advance payments directly to your bank account.

Our Key People

Kanishk Hingorani, CFA

CEO

Keshav

Hingorani

COO

Jayaram Jayaraman

Finance Executive

Testimonials

"Over the last 8 years, Keskan has streamlined my factory finances, hence I have grown my business through the power of finance and good quality products!"

Prem

"Keskan Finance helped me maintain my margins by

financing my raw materials needed for my fabrics.

Immediate payments = Cost Savings!"

Jason

"Keskan financed my orders that I needed to do in fast

track! I could also my factory workers wages immediately

rather than wait to be paid by my customers, more people

need this solution to a big problem here in Tunisia."

Hosni

Keskan Finance has helped me grow my factory orders in a

more aggressive manner, as I could lower my costs and increase

revenue at the same time, which is very hard to do without the

right finance partner!

Shivanna

"Keskan has helped me managing customers that have long

payment cycles, instead of foregoing that business and losing

out on orders, I can now satisfy these kind of customers.

Thanks a lot!"

Mesut

"Keskan Finance is an enabler to grow your business and grow

your margins together. Alhamdulillah! "

Hassan

Our Customers Work with Industry Leaders

Key Milestones:

FAQ

This depends on the end buyer of the goods, and your payment terms with the end buyer, typically it is LIBOR + 4-5% per anum.

No we don’t, but it should be of “substantial” commercial value so both of us are using our resources efficiently.

This depends on the end buyer of the goods, and your payment terms with the end buyer, typically anywhere between $2-3mn is financed.

We have a very minimal admin charge that we levy on disbursements, however this is relationship based, and open to negotiation.

We are 100% transparent with our charges upfront.